According to the announcement released by National Development and Reform Commission and Ministry of Finance on Nov 22 2016, China state cotton auction would kick off from Mar 6, 2017 and tentatively end in end Aug, 2017. Besides, the release of reserved Xinjiang cotton was said to increase. According to recent reserved cotton sales, most market players considered that the state cotton auction might extend, but no official news are seen by now.

Impacted by this news, trading of cotton yarn turned thinner and price slipped on plunging cotton futures. Cotton yarn mills in Nantong were more sensitive to this news than other markets, and price of cotton yarn for home textile dipped by around 200yuan/mt within one week after the news emerged there. Spinners in other markets were not as sensitive as those in Nantong, but price of cotton yarn was also successively revised down.

Quality cotton yarn and open-end cotton yarn plants were active in sustaining firm price. Quality cotton yarn manufacturers expected the prolong of cotton auction and the increase auction volume of Xinjiang cotton may not affect supply of quality cotton, especially cotton available for the production of bleachable or high-count cotton yarn greatly. It was known that supply of quality XPCC cotton remained tight, and sales of bleachable cotton yarn were moderate. Therefore, spinners were unwilling to slash price, coupled with low stocks of finished goods. As for open-end cotton yarn plants, they did not cut price when feedstock like combed noil kept strong after the production and sales of waste cotton and imports of waste cotton were restricted in China and sales of open-end cotton yarn were tolerable.

How will cotton yarn market move in later period?

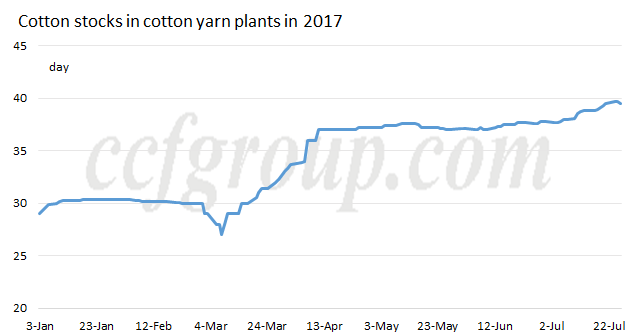

Cotton stocks were slanting high in cotton yarn plants, mainly around 1-2 month in medium-sized spinners. Cotton yarn plants showed obviously higher buying interest in cotton in Jul compared with Jun, worrying cotton supply to be tight in Sep when cotton auction ended and new cotton supply being shortage and expecting cotton price to rise at that time. If cotton auction is extended and the release of Xinjiang cotton increased, above worries of spinners will not exist as cotton price lacks upward momentum. Thus, cotton yarn plants show lower buying intension in cotton with ample cotton stocks, expecting cotton price to slip. Spinners are more likely to replenish cotton under hand-to-mouth approach later, which may exert pressure on cotton price.

Operating rate of cotton yarn and cotton grey fabric plants apparently dropped amid scant orders and heat weather. Some cotton yarn plants turned to two shifts from three shifts, and some directly shut down for holiday temporarily. More weavers scaled down or suspended production, affecting demand for cotton yarn, and most weavers anticipated cotton yarn price to fall later. Coupled with the unclear cotton policy, weavers’ enthusiasm in cotton yarn became much lower.

Many cotton traders cut price by around 100-200yuan/mt under bearish streak and would not slash price much later as promotion may not stimulate sales substantially. Cotton cost may not change much during the beginning of new crop year, and the new cotton price is unlikely to be low. Sep is traditional peak season in textile industry, and downstream demand may improve, supportive to cotton yarn price. Cotton price is not supposed to drop much in short run, more likely to keep inching down. Cotton yarn plants have seen shrinking profit and some have been under losses; thus, price of cotton yarn is likely to follow downtrend on cotton market, but the decrement may be bigger than that of cotton, expected to slip by around 500yuan/mt in Aug.

All in all, cotton stocks are ample now in cotton yarn plants, and spinners may be inactive in replenishing cotton in short run, more likely to purchase on a need-to-basis. Price of cotton yarn is expected to slip further when more downstream plants shut down for holiday temporarily, but decrement may be limited, mainly within 500yuan/mt in Aug.