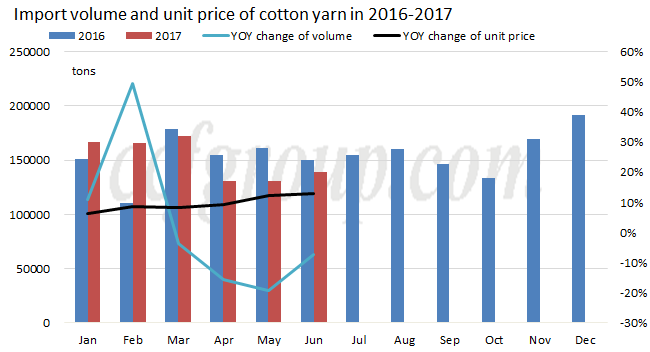

Imports of cotton yarn (Hs code: 5205) totaled 139.1kt in Jun 2017, down 7.2% y-o-y and up 6.7% m-o-m, and imports amounted to 905.2kt in Jan-Jun, 2017, down 0.15% y-o-y. Exports of cotton yarn (Hs code: 5205) totaled 19.9kt in Jun 2017, up by 11.39% y-o-y and down 13.84% m-o-m, and exports amounted to 119.7kt in Jan-Jun, 2017, up by 12.11% compared with the same period of last year. The following part will have deep analysis on the cotton yarn import and export:

I. Import analysis

1. Import volume

Imports of cotton yarn (Hs code: 5205, the following analysis is all based on this Hs code) totaled 139.1kt in Jun 2017, down 7.2% y-o-y and up 6.7% m-o-m, and imports amounted to 905.2kt in Jan-Jun, 2017, down 0.15% y-o-y.

2. Import origins

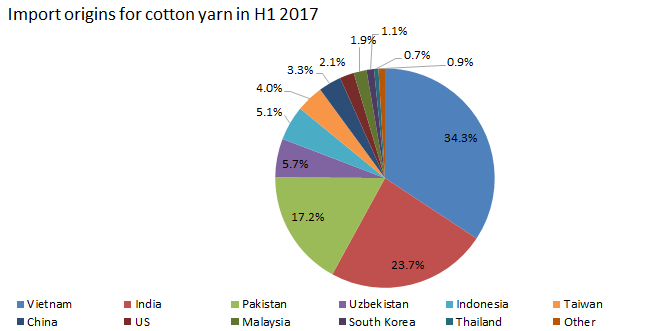

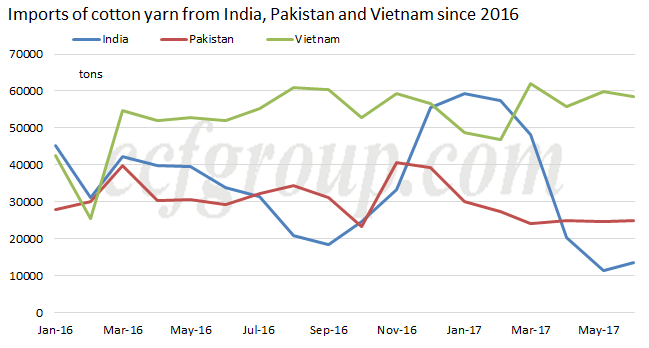

Vietnam, India and Pakistan remained major suppliers for imported cotton yarn in the first half of 2017, with share at 75.1% totally. India was the biggest supplier in Jan-Feb, 2017 but saw falling proportion since Mar, and Vietnam ranked the first place instead. Pakistan surpassed India to be the second biggest origin after Apr, and India remained the third position in Jun even when volume rallied.

3. Major imported cotton yarn by count

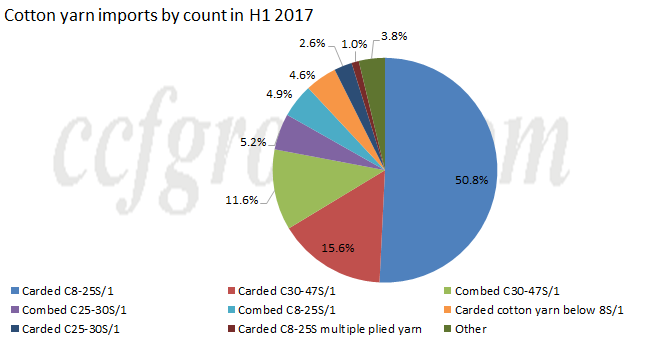

Carded 8-25S/1, carded 30-47S/1 and combed 30-47S/1 were major cotton yarn imported in the first half of 2017, sharing around 50.77%, 15.57% and 11.63% respectively.

| Unit: kt |

Jun-17 |

May-17 |

MOM change |

| Carded C8-25S/1 |

69 |

70.48 |

-2.09% |

| Carded C30-47S/1 |

24.7 |

20.58 |

20.17% |

| Combed C30-47S/1 |

11.7 |

10.84 |

8.20% |

| Carded cotton yarn below 8S/1 |

9.1 |

8.28 |

9.72% |

| Combed C8-25S/1 |

7.5 |

5.679 |

31.28% |

| Combed C25-30S/1 |

6.5 |

5.1 |

27.51% |

| Carded C25-30S/1 |

3.6 |

3.523 |

3.43% |

| Carded C8-25S multiple plied yarn |

1.5 |

1.398 |

8.17% |

Carded 8-25S/1 was the biggest import variety in Jun, with monthly volume at 69kt, down by 2.09% m-o-m. Imports of other major cotton yarn also increased on the month.

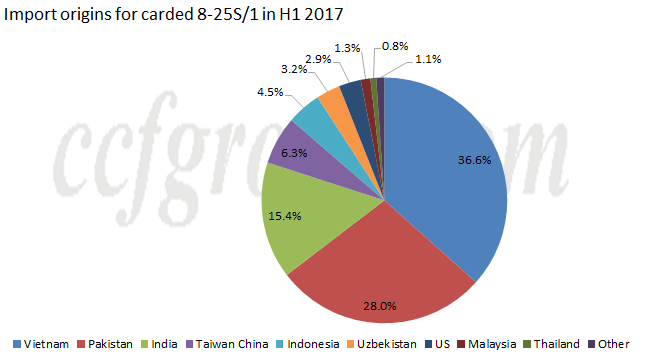

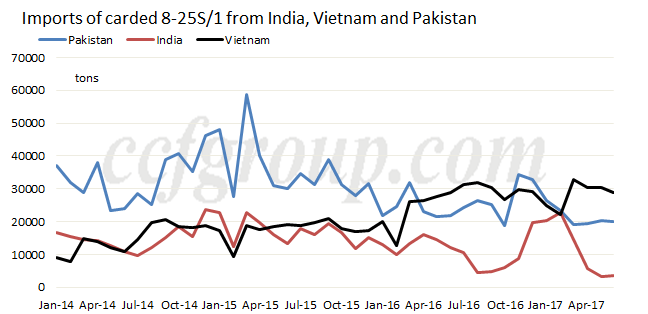

Vietnam exceeded Pakistan to be the biggest supplier for imported carded 8-25S/1 from Apr 2016, keeping edging up, while Pakistan became the largest supplier in Nov 2016 but kept falling later. Vietnam enjoyed absolute advantage after Mar 2017. Proportion of Pakistan stabilized after inching down, while that of India dropped obviously.

Vietnam, Pakistan and Indonesia were major suppliers for imported carded 8-25S/1 in the first half of 2017, occupying 36.61%, 28.01% and 15.37% respectively.

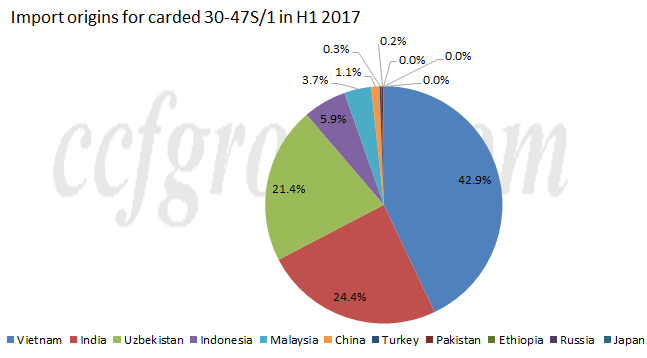

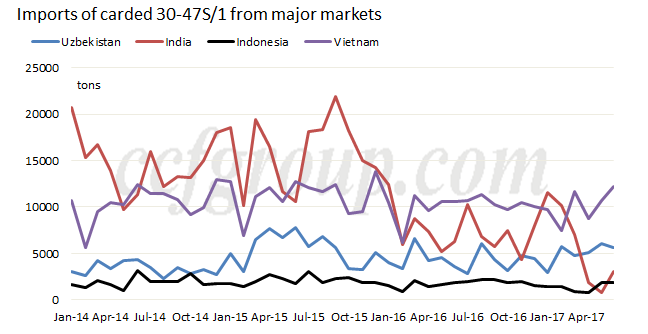

Vietnam, India and Uzbekistan were the major suppliers for imported carded 30-47S/1 in the first half of 2017, possessing 42.95%, 24.4% and 21.38% respectively.

Imports of carded 30-47S/1 from Vietnam and India increased in Jun, while that of Uzbekistani one dipped slightly, and imports of Indian carded 30-47S/1 has been higher than that of Indonesian one. Imports of carded 30-47S/1 from Vietnam and India possessed advantage, while India did not perform as good as Vietnam in 2016, but India surpassed Vietnam to be the biggest supplier since Jan 2017. However, Vietnam overtook India to be the largest supplier in Mar, and imports of Indian carded 30-47S/1 dipped rapidly.

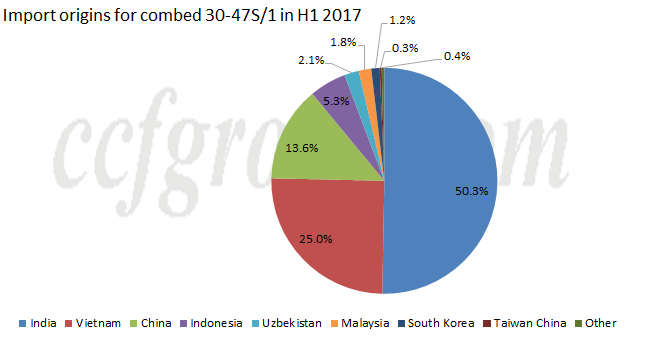

India, Vietnam and China were major suppliers for combed 30-47S/1 in Jan-Jun, 2017, taking up 50.3%, 25.05% and 13.64% respectively.

India enjoyed absolute advantage in combed 30-47S/1 but the volume kept falling since the beginning of 2016 and ranked the second place after Aug 2016, but regained the first position since Oct 2016. But imports of Indian combed 30-47S/1 shrank apparently since Jan 2017, and Vietnam became the largest supplier in May. Currently, market share of Vietnam, India and Indonesia totaled 81%, and Vietnam took up around 44%.

4. Import unit price

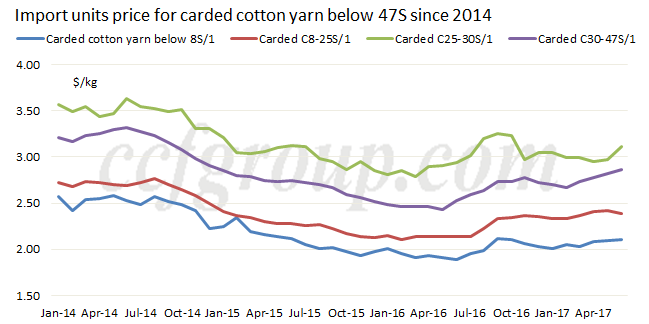

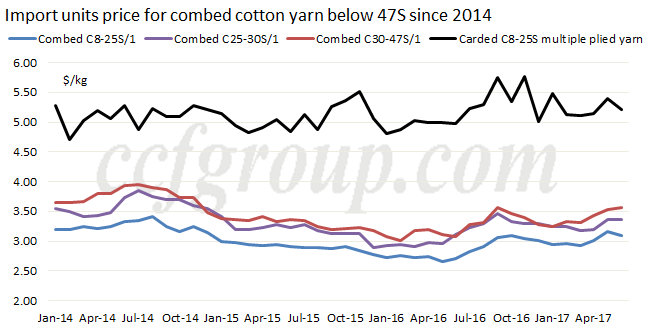

As for the average import unit price for major cotton yarns, it started falling since Oct 2016. Price of imported cotton yarn generally firmed up since Mar 2017, especially combed ones, and increment of combed cotton yarn was big in May. Price of carded cotton yarn also moved up in Jun, but that of combed ones slipped.

5. Conclusion

In summary, imports of cotton yarn (Hs code: 5205) totaled 139.1kt in Jun 2017, down 7.2% y-o-y and up 6.7% m-o-m, and imports amounted to 905.2kt in Jan-Jun, 2017, down 0.15% y-o-y. Vietnam, Pakistan and India kept major suppliers.

Imports of cotton yarn may remain weak in Aug. Price of Chinese local cotton yarn declines weakly when cotton auction is rumored to be extended and cotton production is expected to grow next crop year. Price of forward Vietnamese cotton yarn is supposed to be stable to weak in short run, which may decline later. Indian market shows signals to recover under new GST, and price of Indian cotton and cotton yarn is unlikely to slip in short run, still lacking advantage exported to China. Some Pakistani cotton yarn plants have scaled down production with meager demand from China and unsatisfactory local policy, and such situation may not alter in the second half of 2017. Exports of Pakistani cotton yarn to China may shrink under such circumstance. Therefore, cotton yarn imports may be low in Jul and may keep shrinking in Aug-Sep, and Vietnam may remain the biggest supplier. Imports of cotton yarn from other markets like Taiwan China and Indonesia may grow. As for import unit price, price is supposed to be weak to stable in Jul and move lower in Aug.

II. Export analysis

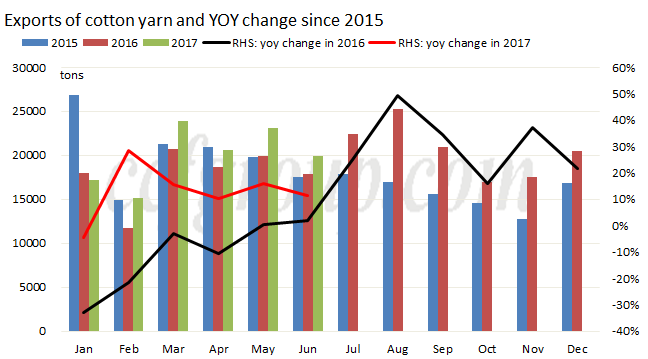

1. Cotton yarn exports increased in the first half of 2017

Exports of cotton yarn (Hs code: 5205, and the following analysis is all based on this Hs code) totaled 19.9kt in Jun 2017, up by 11.39% y-o-y and down 13.84% m-o-m, and exports amounted to 119.7kt in Jan-Jun, 2017, up by 12.11% compared with the same period of last year.

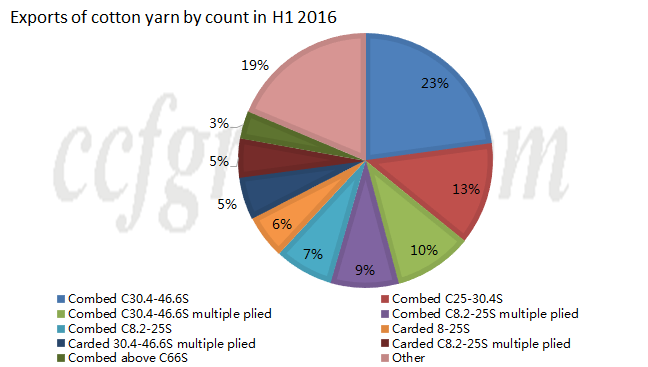

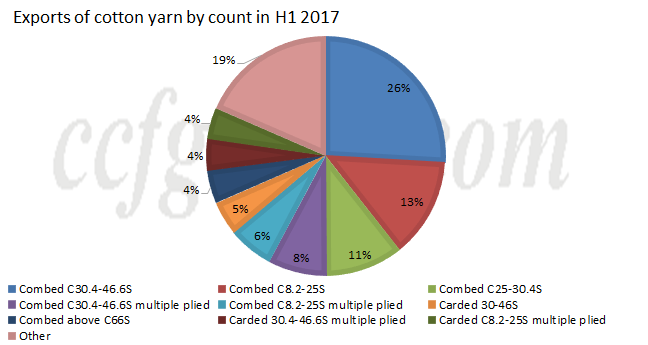

2. Major cotton yarn variety exported changed—exports of combed 8.2-25S grew apparently

Export structure of cotton yarn altered in H1 2017, and combed 30.4-46.6S remained major descriptions exported, with proportion up by 3% to 26% and volume up by 27.14% y-o-y. Exports of combed 8.2-25S also surged to the second largest variety exported in H1 2017, with share up by 6% to 13% and volume rising by 101.73% y-o-y. Besides, exports of carded 30.4-46.6S, combed cotton yarn above 66S and combed 54.8-66S also hiked by 72.51%, 42.77% and 165.1% y-o-y.

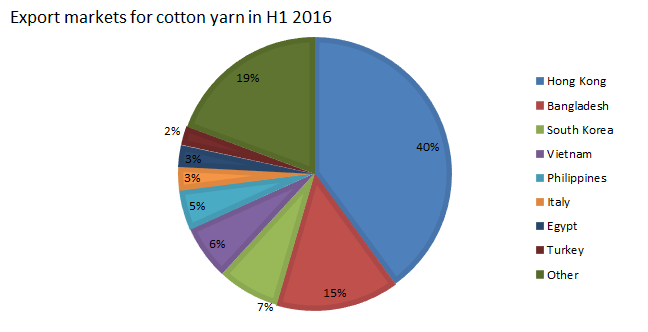

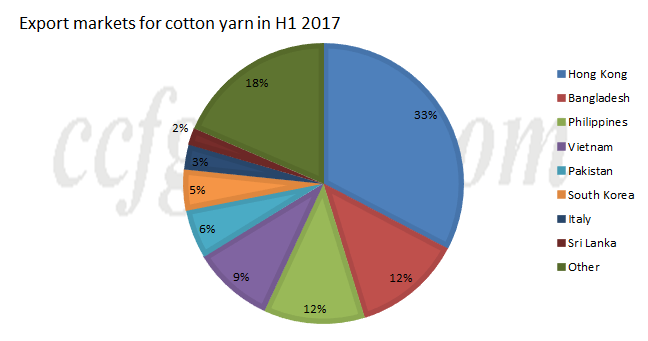

3. Philippines, Vietnam and Pakistan emerged

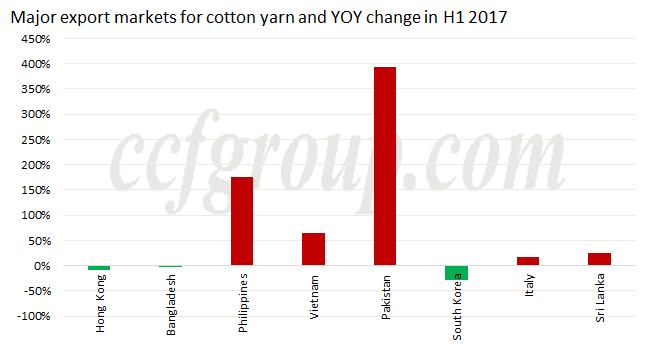

As for major export destinations for cotton yarn, Southeast Asian markets emerged in the first half of 2017 with the development of downstream sectors. Exports of cotton yarn to Hong Kong kept decreasing in H1 2017, with share down by 7% to 33% and volume down by 8.38% on the year. Bangladesh remained the second largest destination for cotton yarn in H1 2017, with proportion down by 3% to 12%. Exports of cotton yarn to Southeast Asian markets like Philippines, Vietnam and Pakistan soared by 176%, 63.86% and 392.9% on the year respectively in H1 2017. Besides, Philippines overtook Bangladesh to be the second largest market from Apr 2017.

In summary, exports of cotton yarn improved by 12.11% on the year to 119.7kt in Jan-Jun, 2017, and exports to Bangladesh were in stagnation this year despite of continuous increase in 2016. Exports of cotton yarn to Philippines and Pakistan surged in H1 2017, and those to Vietnam gradually recovered. Major cotton yarn exported changed little, with exports of combed 30.4-46.6S keeping increasing and those of low-count cotton yarn climbing up. Chinese cotton yarn enjoyed greater competitiveness on global market this year, coupled with the depreciating of RMB, exports of cotton yarn grew in the first half of 2017.