1. Ordering time and price gap change of mainstream imported cotton yarn

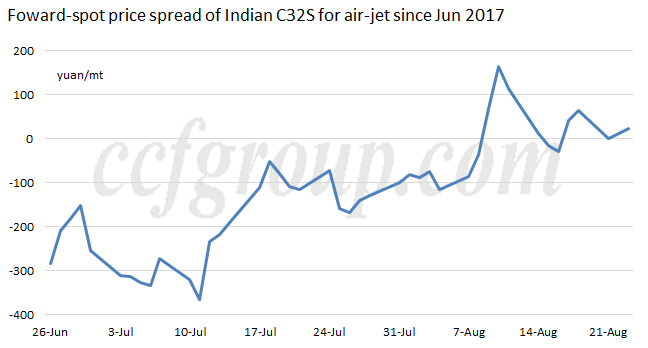

Sep arrivals of Indian cotton yarn were mainly ordered in end-Jul and end-Aug, with price for forward carded 32S for air-jet staying at $2.83/kg, with 2-month forward exchange rate at 6.71, flatting with last month. But RMB turned firmer, so cost of forward Indian 32S dropped apparently. Price spread between forward and spot Indian 32S obviously narrowed. Given price disparity, arrivals of Indian cotton yarn may rise in Sep compared with Aug.

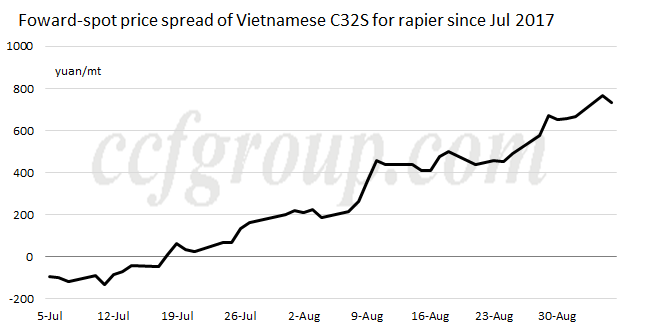

Sep arrivals of Vietnamese cotton yarn were mainly procured in early-Aug and early-Sep, with forward price for carded 32S for rapier staying at $2.83/kg, up by $0.01/kg compared with Aug, with 2-month forward exchange rate at 6.66 at that time. RMB greatly appreciated, dragging down purchasing cost. Price gap between forward and spot goods enlarged. Thus, arrivals of Vietnamese cotton yarn in Sep may increase on the month.

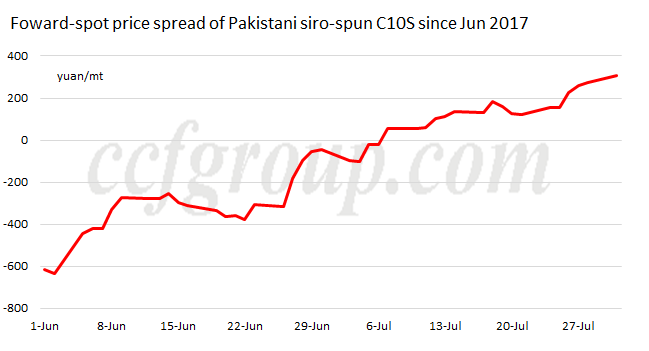

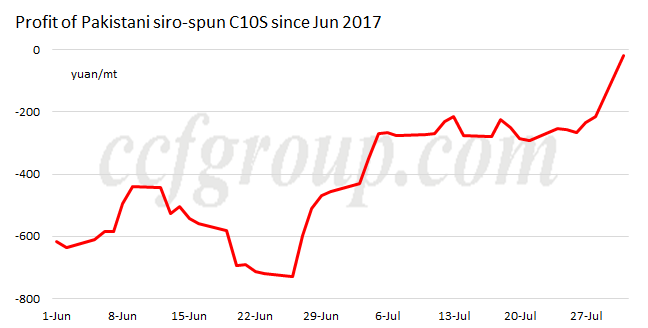

Sep arrivals of Pakistani cotton yarn were mainly ordered in early-Jul and early-Aug, with forward grade-A siro-spun 10S reaching $2.30/kg, down by $0.03/kg compared with Aug, with 2-month forward exchange rate at 6.79 at that time. RMB firmed up, lowering ordering cost. Price of forward siro-spun 10S became lower than that of spot goods in China. Based on price gap, arrivals of Pakistani cotton yarn in Sep may rise on the month.

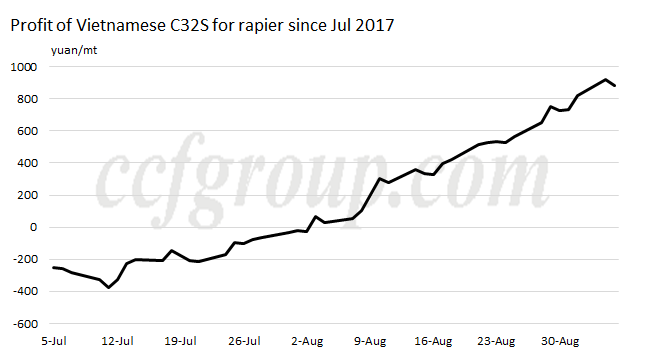

2. Profit change of mainstream imported cotton yarn

Profits of Sep arrivals of Vietnamese, Indian and Pakistani cotton yarn increased, so arrivals of cotton yarn from Vietnam, India and Pakistan in Sep are expected to ascend on the month.

3. Inventory change at major China ports

Inventory of imported cotton yarn apparently ascended in Sep. Demand for imported cotton yarn was moderate in traditional peak season Sep, but could not be described as real peak season. However, stocks of imported cotton yarn still climbed up.

4.Traders’ reflection

72% of traders under survey reflected that Sep arrivals of imported cotton yarn may rise compared with Aug, 14% of traders thought Sep arrivals may slightly decrease on the month and 14% of traders thought Sep imports of cotton yarn may be flat with Aug. Most players under survey reflected that cotton yarn imports may be not low in Oct but are likely to decrease on the month affected by the National Day holiday.

5. Summary and outlook

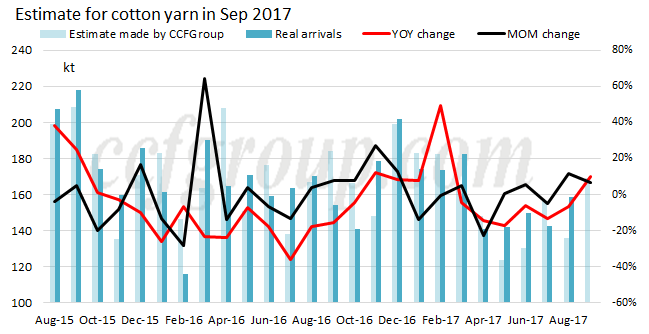

According to survey made by CCFGroup and combined with profit and price gap change, imports of cotton yarn may increase by around 6.42% on the month to 169kt in Sep, and imports of cotton yarn containing more than 85% of cotton is expected to be around 156.7kt. Imports of cotton yarn from India, Pakistan and Vietnam are supposed to rise on the month in Sep, and imports of cotton yarn to Guangdong, Zhejiang, Jiangsu and Shandong are likely to rise on the month too, with increment of Shandong expected to be bigger.

Note: The survey (combined with telephone and WECHAT) made by CCFGroup involves around 40 companies, containing around 55% of total cotton yarn imports. The sampling survey is incomplete and the result is only for reference.