|

|

|

home > Events

China's MEG up in anticipations of better supply-demand for Q2

China's MEG market has remained rangebound for around two weeks, and domestic spot prices shivered around 7,000yuan/mt. Spot price fell to around 6,600yuan/mt weighed by decline in commodities previously, while buying sentiment was favorable as traders and polyester plants were active to enquire. In the meantime, market confidence improved as polyester sales ratio picked up with the recovery in end-user demand. MEG prices are likely to keep its upward move in short term on the back of good fundamentals and buying activities from major players.

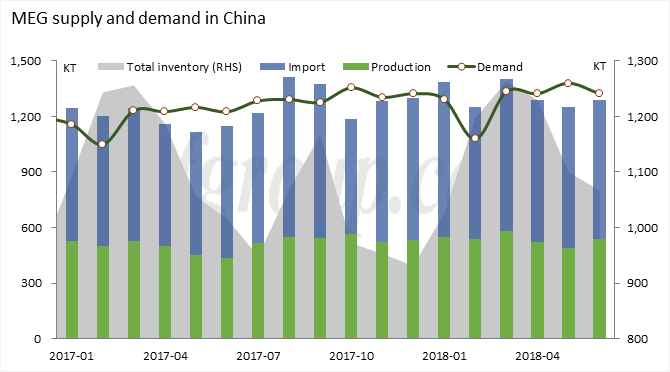

Supply-demand condition is favorable for the second quarter. Total MEG inventory is expected to decrease by about 200kt in April-May, to slightly higher than 1 million mt. Total MEG inventory has stood at its periodical high.

In demand side, operating rate of downstream weaving sectors has increased to more than 80%, and orders were better than previous expected. Demand from end-users would be a strong support to the market in the second quarter. Operating rate of polyester plants was around 93%. Product profits were favorable with cash flows of PET bottle chip, PSF, POY and FDY up to around 600-700yuan/mt. Cash flow of PET fiber chip reached around 200-300yuan/mt. In short term, operating rate of polyester plants will sustain at high level. Polyester capacity expanded by 930kt/year in the first quarter and was expected to increase by around 2.5 million mt/year in the second quarter. Demand for MEG is expected to keep firm.

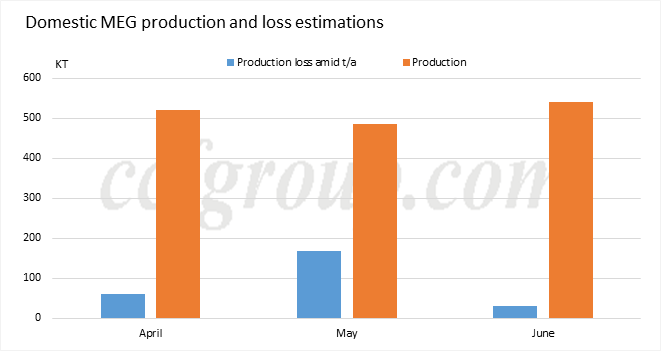

In 2018, units in Taiwan and Japan mainly undertakes turnarounds in turn. In domestic market, capacity for turnarounds in Q2 totals more than 3 million mt/yea15r, taking up to more than a third of China's total MEG capacity (8.935 million mt/year by now). Production loss due to unit turnarounds would be around 250kt in Q2. MEG market was in apparent contango structure on optimistic outlook for forward materials.

However, some market participants also concerned about the startups of new coal-based MEG units. ECO Coal Chemical is expected to start in April, while others are planned to start around May. But it takes time from testing run to getting products. Output from new units would be sold into the market around June. So, MEG supply will be still tight in April and May.

In terms of market structure, spot materials become more concentrated with active buying from some traders and polyester plants. Overall supply shrank slightly but was not tight yet. Some market participants still worried about that during the uptrend. But MEG prices dropped sharply since late February with CFR China price down from $1,050 to $915/mt. The arbitrage room to China domestic market narrowed gradually, and deep-sea cargo arrivals would also decrease. There were still lots of cargoes arrived in March, and port inventory is expected to see its peak in early April. Then the supply will shrink gradually, and port inventory is expected to decrease with starts of new polyester plants.

Prices rebounded in anticipations of improvement in fundamentals of tight supply but rising demand. Eyes could also rest on macro environment and the movements of commodities.

|

|