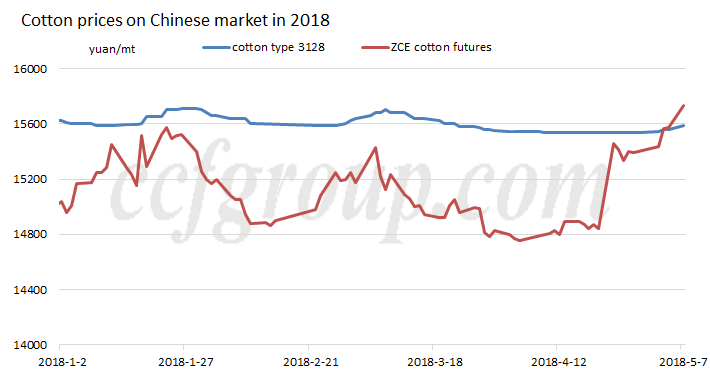

On May 7, the major contract, Sep contract on Zhengzhou cotton futures market, witnessed over 1 percent increase for the first time in two months and the tendency is favorable in short run. Nevertheless, the state cotton auction is going on, registered warehouse receipts hit a new high and the market is oversupplied. Under such condition, how does the cotton futures market climb up? According to our analysis, the rise is mainly dominated by the "mood".

1. Reasons

In fact, Zhengzhou cotton futures have signs to rise early, but the unfavorable fundamental puts the pressure on the uptrend.

(1) ZCE cotton futures market rallies with trade war stimulus

In early April, ZCE cotton futures market declined, but had not seen large decrease, so shorts lacked confidence and the longs increased the open interests. Meanwhile, buyers on spot market procured the on-call cotton sources, pushing up the ZCE cotton futures. On April 4, China announced to add additional 25 percent tariffs on cotton originating from U.S. Though the market was quiet, market mindset has changed somewhat, and players concerned about the supply of 2018/19 U.S. cotton, which supported the ZCE cotton futures somewhat. Moreover, the relationship between ICE and ZCE cotton futures became closer due to the trade dispute.

In late April, downstream yarn and fabric market rebounded slightly, and orders increased, supportive to the ZCE cotton. At that time, Sep cotton contract was range-bound between 15,360 and 15,460yuan/mt. The upward tendency was seen, but the strength was weak.

(2) A squeeze is building on ICE cotton futures

The quantity of on-call cotton contracts on ICE July contract has hit a historical high, and U.S. cotton is oversold, while registered warehouse receipts are very limited. By April 27, outstanding on-call cotton in July contract is 55,600 lots (1.26 million tons), while by May 2, the warehouse receipts are only 75,600 bales (17.2kt). Therefore, market players worried about a squeeze. ICE cotton futures market kept strong overall.

(3) Froward contracts on ZCE cotton futures are sensitive

With on-going de-stocking in China, whether the state cotton auction will continue next season remains uncertain, so forward contracts are relatively sensitive towards the bullish factors. Influenced by the possible squeeze on ICE cotton, Jan’19 contract on ZCE cotton market moved up firstly, gaining support to the long positions.

After the rise on forward contracts, nearby contracts climbed up as well. Moreover, the weather speculation arouses. Recently, Xinjiang releases the blue warning of wind and rainstorm. Film in cotton fields in many regions is needed to redone, which may influence the sprout of cotton crops. Speculators pay more attention to the ZCE cotton futures and the market is mainly driven by the “mood”.

2. How far the upswing will go?

This round of upswing is mainly dominated by the “mood”, and the fundamental factor weakens, so it is not fit to analyze from the logic of fundamental. From the angle of technical analysis, the major contract has not broken through the first resistance level of 15,740yuan/mt and it may break through later and the second resistance level is at around 15,940yuan/mt.