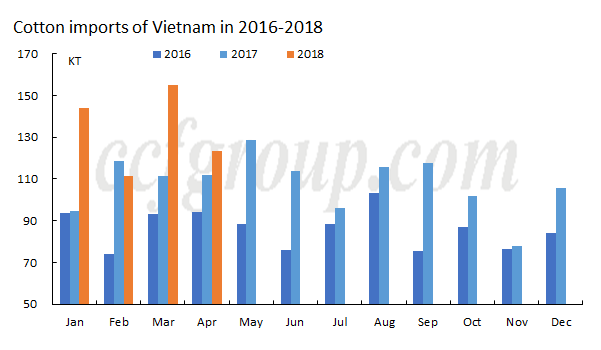

In April 2018, Vietnam imported 123.2kt of cotton, an increase of 10.1% year on year, but down 20.3% month on month. Cotton imports continued to see growth on the year in April. For import origins, U.S. kept the top one supplier, but the proportion declined obviously. India and Brazil were the second and third largest suppliers and the import volumes kept high. In the first four months of 2018, imports from Brazil witnessed a significant yearly growth of 317.9% to 80kt.

1. Cotton imports rise year on year in April, 2018

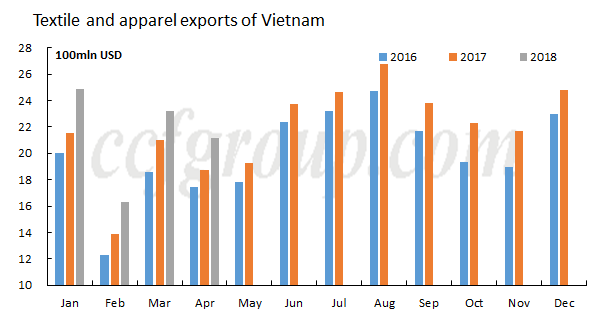

Vietnam exported $2.116 billion of textile and garments in April 2018, up 12.9% year on year, but down 8.7% month on month, and from January to April, the exports totaled $8.556 billion, up 13.77% year on year. End-user market kept the good growth rate and consumption for cotton continued to rise, and is expected to hit a new high. Export structure has no big change, as U.S. remained the largest export destination.

Cotton imports reached 123.2kt in April 2018, an upswing of 10.1% year on year, but down 20.3% month on month, and in the first four months of 2018, cotton imports amounted to 533kt, up 22.2% year on year. Cotton imports decreased obviously in April, while viewed from textile imports, domestic textile industry kept good and yarn imports and exports were also high. The major reasons for the decline were the seasonal adjustment and the higher international cotton prices.

2. Imports of Brazilian cotton soar

Looking from the import structure, import origins were still U.S., India and Brazil. From January to April 2018, U.S. cotton imports totaled 259kt, basically flat from last year; Indian cotton imports were 114.5kt, up 42.7% year on year; Brazilian cotton imports were 80kt, an upswing of 317.9% and Australian cotton imports were 8.1kt, up 92.6%.

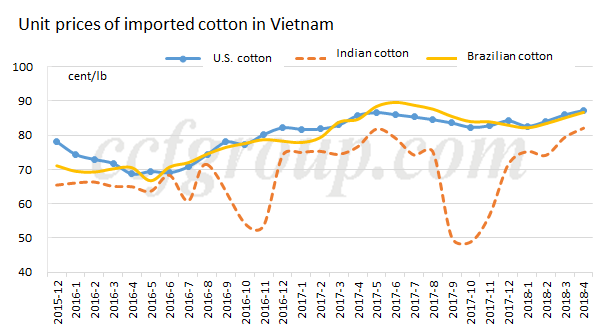

From February 2018, unit price of imported cotton continued to rise, which was related to the strong ICE cotton futures. U.S. cotton was definitely close to the trend of ICE cotton futures. For Indian cotton, arrivals speeded up in April entering into the new fiscal year and downstream mills’ replenishment and exports remained good, so cotton prices were relatively strong overall. Nevertheless, the exchange rate of US dollar against Indian Rupee went firmer from mid-April, USD price of Indian cotton witnessed slower increment. In Brazil, new cotton has not arrived on the market during February and March, while domestic mills have good demand for cotton, especially for high-grade ones, leading to higher domestic prices than export prices.

3. Summary

In general, cotton imports and end-user textile and garment exports show the good development trend of Vietnam’s textile industry, but the market also shows weakness and the new capacities go high-end. Prices of U.S. cotton, Brazilian cotton and Australian cotton are relatively firm, so the cotton costs for Vietnam are expected to rise further.