|

|

|

home > Events

Cotton linter import of China warming up this year

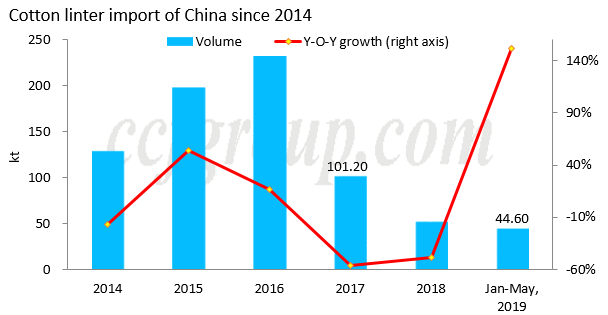

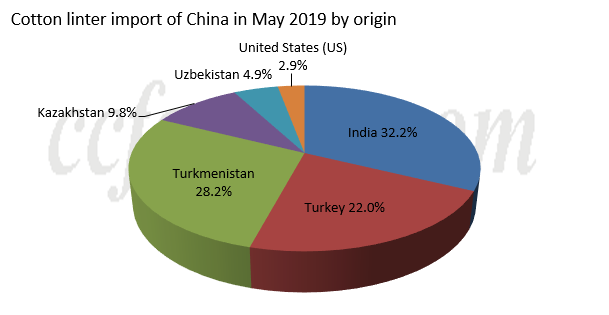

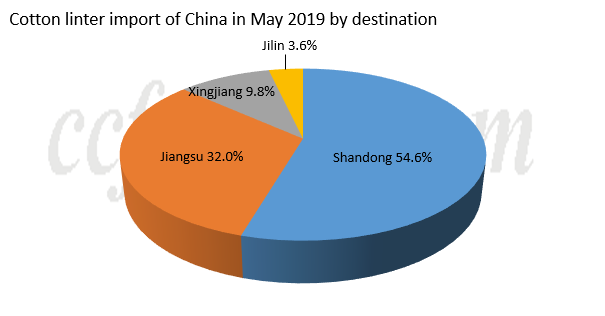

Cotton linter import of China has been recovering this year. The volume in Mar hits 2-year high and keeps relatively stable during Apr-May.  The import volume was small in the same period of last year, but the output of China is limited this year and there is widening spread between domestic and import prices, spurring growing demand for imports. According to customs data, cotton linter import of China totals 9,546.5 tons in May, up 3.4% m-o-m and up 156% y-o-y. The import volume was small in the same period of last year, but the output of China is limited this year and there is widening spread between domestic and import prices, spurring growing demand for imports. According to customs data, cotton linter import of China totals 9,546.5 tons in May, up 3.4% m-o-m and up 156% y-o-y.  China totally imports 44.6kt of cotton linter in Jan-May this year, about 1.51 times of that in Jan-May, 2018. The volume has reached 85% of that of 2018 and the import in the first half of this year is expected to exceed the total volume of 2018. China totally imports 44.6kt of cotton linter in Jan-May this year, about 1.51 times of that in Jan-May, 2018. The volume has reached 85% of that of 2018 and the import in the first half of this year is expected to exceed the total volume of 2018.  The import price starts to stop falling and rebound with increasing import volume. In May, the price average at $371.3/mt, up 21.7% m-o-m but down 32.9% y-o-y, with smaller yearly decrease of 10.3%. The price is generally below $400/mt, which can compete with domestic price. The import price starts to stop falling and rebound with increasing import volume. In May, the price average at $371.3/mt, up 21.7% m-o-m but down 32.9% y-o-y, with smaller yearly decrease of 10.3%. The price is generally below $400/mt, which can compete with domestic price.  China's cotton linter imports are concentrated. India continues to take the lead in origins as the volume occupies about 1/3 of total in May, but the proportion has been falling. Central Asia is the second largest origin as the imports from Turkmenistan increase substantially, taking up 28% of total. Turkey keeps stable market share of around 20%. Cotton linter imports from the US have been increasingly volatile after additional tariff of 25% has been imposed since Jul 6, 2018. No linters are imported from US in Apr, but the volume increases somehow in May. China's cotton linter imports are concentrated. India continues to take the lead in origins as the volume occupies about 1/3 of total in May, but the proportion has been falling. Central Asia is the second largest origin as the imports from Turkmenistan increase substantially, taking up 28% of total. Turkey keeps stable market share of around 20%. Cotton linter imports from the US have been increasingly volatile after additional tariff of 25% has been imposed since Jul 6, 2018. No linters are imported from US in Apr, but the volume increases somehow in May.  The destinations of imported cotton linter are generally regions where cotton linter pulp and refined cotton plants are located or active trading areas of cotton linter. Shandong has been in leading position whose percentage reaches 55% of total in May, which is followed by Jiangsu (32%) and Xinjiang (10%). It is noteworthy that the import of Xinjiang recovers obviously this year. Cotton linter import of China has resumed this year. Coupled with the influence of Sino-US trade friction, Chinese companies import more linters from Turkey and Central Asia. Cotton linter output of China is now limited and supply gap is mainly filled by old and imported linters. When the market is in transition period later, cotton linter import market is still worth expecting in case of no hiking import price. The destinations of imported cotton linter are generally regions where cotton linter pulp and refined cotton plants are located or active trading areas of cotton linter. Shandong has been in leading position whose percentage reaches 55% of total in May, which is followed by Jiangsu (32%) and Xinjiang (10%). It is noteworthy that the import of Xinjiang recovers obviously this year. Cotton linter import of China has resumed this year. Coupled with the influence of Sino-US trade friction, Chinese companies import more linters from Turkey and Central Asia. Cotton linter output of China is now limited and supply gap is mainly filled by old and imported linters. When the market is in transition period later, cotton linter import market is still worth expecting in case of no hiking import price.

|

|