|

|

|

home > Events

Tepid rayon grey fabric market, what next?

Recently, rayon grey fabric market remained fairly dull in peak season, and most of weavers still sold stocks at low price. Traditional “Golden Sep and Silver Oct” peak season anticipation was frustrated and overall peak season performed not as good as that in previous years.

1. Rayon grey fabric market witness bleak sales and weak price

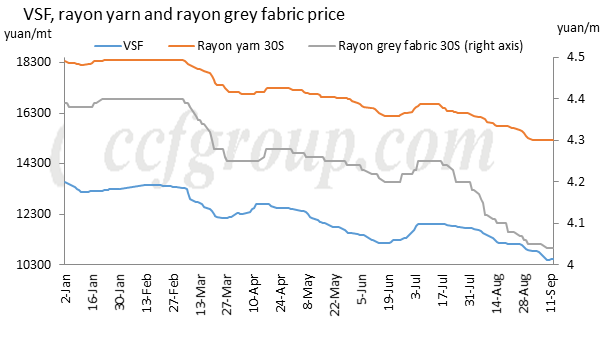

In line with increasing price of upstream feedstock, price of yarn stabilized. Weavers still focused on selling stocks actively and lowering inventory of finished products. Knitted rib fabric enjoyed better sales, which drove sales of vortex-spun rayon yarn. Rayon grey fabric for weaving performed obviously not as good as expected in peak season. There was more production cut of weaving mills in Gaomi, Nantong and Shijiazhuang, and fabric mills in Shandong, Hebei, Shaanxi and Zhejiang shifted to produce polyester/rayon fabric and interwoven fabric. As peak season atmosphere was not obvious, demand for conventional products shrank, overall supply exceeded demand, and the price was sluggish. In Mid-Autumn Festival, weavers mainly had one day holiday and some had three-day holidays, and most of weavers still lacked confidence towards future market trend.

2. End-users weak demand leads to slack market

Due to uncertain external environment and unstable price of feedstock, traders mainly stood on the sidelines. The market started to improve from late-Aug, but there was no obvious peak season atmosphere and most of weavers held low anticipation towards peak season. Sales and price of rayon grey fabric market continued to be weak and sluggish. Apart from influence of external objective factors, the main reason was that relationship between supply and demand changed, especially obvious shrinkage of sales ratio of end-users products. Since there is no subdivided category of rayon apparel, it is illustrated by apparel production and export.

In line with increasing price of upstream feedstock, price of yarn stabilized. Weavers still focused on selling stocks actively and lowering inventory of finished products. Knitted rib fabric enjoyed better sales, which drove sales of vortex-spun rayon yarn. Rayon grey fabric for weaving performed obviously not as good as expected in peak season. There was more production cut of weaving mills in Gaomi, Nantong and Shijiazhuang, and fabric mills in Shandong, Hebei, Shaanxi and Zhejiang shifted to produce polyester/rayon fabric and interwoven fabric. As peak season atmosphere was not obvious, demand for conventional products shrank, overall supply exceeded demand, and the price was sluggish. In Mid-Autumn Festival, weavers mainly had one day holiday and some had three-day holidays, and most of weavers still lacked confidence towards future market trend.

2. End-users weak demand leads to slack market

Due to uncertain external environment and unstable price of feedstock, traders mainly stood on the sidelines. The market started to improve from late-Aug, but there was no obvious peak season atmosphere and most of weavers held low anticipation towards peak season. Sales and price of rayon grey fabric market continued to be weak and sluggish. Apart from influence of external objective factors, the main reason was that relationship between supply and demand changed, especially obvious shrinkage of sales ratio of end-users products. Since there is no subdivided category of rayon apparel, it is illustrated by apparel production and export.

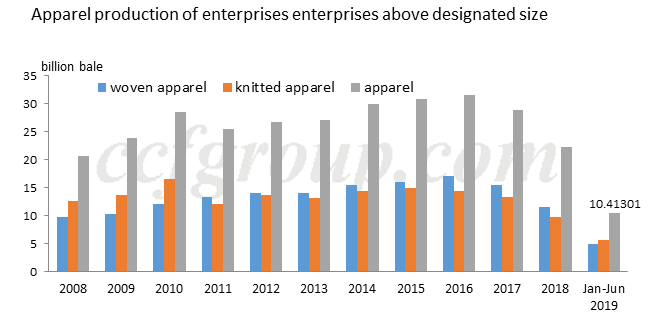

Due to changes in market demand and consumption transformation, and rapid follow-up of apparel production capacity in Southeast Asia, production of apparel in China fell sharply in recent years. In the first half of 2019, it dropped further on basis of a large fall in 2018. From Jan to Dec of 2018, garment enterprises above designated size completed a total of 22.274 billion garments, down by 22.6% year-on-year. From Jan to Jun 2019, garment enterprises above designated size completed a total of 10.413 billion garments, down by 1.09% year-on-year.

Due to changes in market demand and consumption transformation, and rapid follow-up of apparel production capacity in Southeast Asia, production of apparel in China fell sharply in recent years. In the first half of 2019, it dropped further on basis of a large fall in 2018. From Jan to Dec of 2018, garment enterprises above designated size completed a total of 22.274 billion garments, down by 22.6% year-on-year. From Jan to Jun 2019, garment enterprises above designated size completed a total of 10.413 billion garments, down by 1.09% year-on-year.

As for apparel exports, China exports became more divided in recent years, especially export of cotton apparel shrank rapidly. From Jan to Dec 2018, cotton apparel exported 13.03 billion pieces, down by 3.2% year-on-year and 30% lower than that in 2006. In Jan to June 2019, export of cotton apparel reached 6.07 billion pieces, which continued to decline.

In summary, due to intensification of trade protectionism and asymmetric advantages of textile and apparel in Southeast Asian countries, China textile industry lacked foreign demand. End-users apparel industry is a dominant industry in China traditional industries, but new competitive advantages did not establish. Amid decline of traditional advantages and transformation of domestic consumption and change of supply and demand, demand burden on spot and forward market increased significantly. Rayon grey fabric market peak season atmosphere was not obvious and the market in Sep did not improve significantly. Most of weavers held low anticipation towards peak season and may still focus on selling stocks with stable price.

As for apparel exports, China exports became more divided in recent years, especially export of cotton apparel shrank rapidly. From Jan to Dec 2018, cotton apparel exported 13.03 billion pieces, down by 3.2% year-on-year and 30% lower than that in 2006. In Jan to June 2019, export of cotton apparel reached 6.07 billion pieces, which continued to decline.

In summary, due to intensification of trade protectionism and asymmetric advantages of textile and apparel in Southeast Asian countries, China textile industry lacked foreign demand. End-users apparel industry is a dominant industry in China traditional industries, but new competitive advantages did not establish. Amid decline of traditional advantages and transformation of domestic consumption and change of supply and demand, demand burden on spot and forward market increased significantly. Rayon grey fabric market peak season atmosphere was not obvious and the market in Sep did not improve significantly. Most of weavers held low anticipation towards peak season and may still focus on selling stocks with stable price.

|

|