Currently, the elements to see bearish expectation on Chinese cotton market have supply/demand, warehouse receipts pressure, the state reserved cotton stocks, higher output in 2017/18 season and VAT adjustment after Jul 1, 2017, and the elements to see bullish expectation have the selling volumes of reserved Xinjiang cotton, cost and structural shortage, intensive replenishment in Aug and the transportation from Xinjiang to inland in end 2017. In general, the bears are dominated the market at present and bulls counters the bears periodically.

I. Driven force of bears

1. Supply and demand

| Daily trading volumes of reserved cotton at 21.3kt during Jun 27-Aug 31 (unit: KT) |

| Time |

Supply |

Demand |

Monthly consumption |

| Beginning stock |

Output |

Trading volumes of reserved cotton |

import |

consumption |

Ending stock |

| 2016/17season |

1223.7 |

4500 |

3092.6 |

1059 |

8069 |

1806 |

672.4 |

| 2016/09-2017/05 |

1223.7 |

4400 |

1898.6 |

864 |

6134 |

2252 |

681.6 |

| 2017/06-2017/08 |

2252.3 |

100 |

1194 |

195 |

1935 |

1806 |

645 |

| Daily trading volumes of reserved cotton at 15kt during Jun 27-Aug 31 (unit: KT) |

| Time |

Supply |

Demand |

Monthly consumption |

| Beginning stock |

output |

Trading volumes of reserved cotton |

import |

consumption |

Ending stock |

| 2016/17season |

1223.7 |

4500 |

2840.6 |

1059 |

8069 |

1554 |

672.4 |

| 2016/09-2017/05 |

1223.7 |

4400 |

1898.6 |

864 |

6134 |

2252 |

681.6 |

| 2017/06-2017/08 |

2252.3 |

100 |

942 |

195 |

1935 |

1554 |

645 |

Note: for the forecast basis for the table above, you can refer to the previous insight of "Will China cotton supply and demand balance in 2016/17?"

2014/15 ending stocks in the market reached 1.468 million tons, trading activities were dull at that time and Zhengzhou cotton futures market moved downward; in 2015/16 season, ending stocks were 1.224 million tons and sales were smooth and demand outpaced supply. State cotton auction extended one month from Aug to Sep, 2016. In 2016/17 season, the ending stocks are estimated to be higher than that in previous two seasons. On concern about buoyant economy and good profits for mills, the market has higher tolerance for the ending stocks and the low trading volumes of reserved cotton may lead to the balance of supply and demand. Nevertheless, supply in Xinjiang is tight while that in inland is loose.

2. Warehouse receipts pressure

| Time |

Registered warehouse receipts |

Open interest of Sep contract |

registered warehouse receipt/open interests of Sep contract |

price trend of ZCE Sep contract |

Chinese cotton 3128 |

| 2014-6-26 |

119 |

26520 |

7.54% |

shiver weakly |

down |

| 2015-6-26 |

1628 |

230546 |

11.86% |

move downward |

down |

| 2016-6-26 |

886 |

244120 |

6.10% |

Move upward |

up |

| 2017-6-26 |

3307 |

188724 |

29.44% |

move sideways |

Stable to soft |

Zhengzhou cotton futures have been range-bound for two weeks and warehouse receipts continued to flow out. Moreover, the open interests of Sep contract also have been reducing. Compared to the corresponding period of previous three years, the proportion of Sep contract’s warehouse receipts remained large and the consumption pressure kept on.

3. State reserved cotton stocks

| Remnant reserved cotton stocks (unit: KT) |

| stocks left from 2003-2010 |

880 |

| Crop year |

Cotton auction |

Cotton reserve |

remnant stocks |

| Dec-11 |

- |

3250 |

4130.2 |

| 2012/13 |

371 |

6670 |

7093.6 |

| 2013/14 |

264 |

6600 |

11055.7 |

| 2015 |

6 |

- |

10992.3 |

| 2016 |

266 |

- |

8333.3 |

| 2017-6-26 |

162.25 |

- |

6710.8 |

By Jun 26 2017, nearly 1.62 million tons of reserved cotton have been transacted and about 6.71 million tons of reserved cotton are still left in state warehouses. In 2017, the trading volumes of reserved cotton are expected to reach 2.22-2.47 million tons, then by end Aug, the stocks in state warehouse may reach 5.86-6.11 million tons. Currently, most market participants thought that the state cotton auction would keep on in 2018.

4. VAT of cotton reduces to 11% from Jul 1, 2017

Starting Jul 1, 2017, VAT of cotton in China will adjust lower from 13% to 11%. For ginners and traders, the lower tariff is beneficial for them, to reduce the deficits risks and increase the discussion space. For spinning mills, the input VAT will adjust from 13% to 11%, while output VAT remains at 17%, so the deduction of input VAT decreases by 2%, and its profits narrow somewhat. Therefore, they are more cautious to purchase cotton.

5. Output and consumption in 2017/18

| Crop year |

Beginning stock |

output |

import |

consumption |

export |

Ending stock |

| 2017/18 |

-17% |

5% |

4% |

3% |

0% |

-19% |

| 2016/17 |

-14% |

-4% |

-4% |

14% |

-75% |

-24% |

| 2015/16 |

8% |

-21% |

-35% |

-7% |

150% |

-2% |

| 2014/15 |

25% |

-6% |

-40% |

-1% |

60% |

10% |

| 2013/14 |

62% |

-9% |

-36% |

-1% |

-38% |

19% |

In USDA’s May supply and demand report, output and imports of China is predicted to increase compared to last season and the increment is higher than that of consumption. Meanwhile, output in most countries is also predicted to rise. Therefore, global cotton supply is likely to be loose in 2017/18, which puts pressure on cotton prices later.

II. Driven force of bulls

1. Selling volumes of reserved Xinjiang cotton

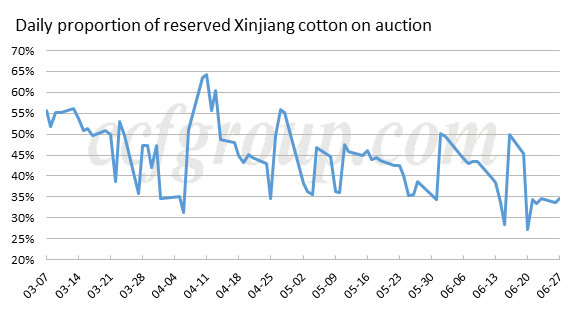

Since the beginning of state cotton auction in Mar 2017, there is always the doubt that whether the daily quantity of reserved cotton will keep at 30kt. Viewed from the chart, the planned selling volumes of reserved Xinjiang are actually decreasing gradually, which gives a driven force for bulls.

2. Cost support and structural shortage

2016/17 Xinjiang cotton has completed the ginning before the Spring Festival and with the storage charge and interests rate, the cotton costs are close to the spot price level by now. Therefore, some sellers who face tight capital cut prices to sell. Despite of slow trading activities, sales were seen. Currently, structural shortage appears severely. Mills are seeking for quality cotton, but 2016/17 imported cotton prices are expensive, so some spinners use imported cotton previously turn to use Xinjiang cotton, leading to higher demand for quality Xinjiang cotton this year. So supply of quality cotton on the market decreases obviously. Some sellers become tight sellers and hold the quality sources at hand, expecting that prices to be higher later.

3. Mills’ intensive replenishment in Aug

2017 state reserved cotton sales will end on Aug 31, 2017 and the 2017/18 cotton will be harvested and ginned in Sep. The intensive arrivals of new cotton are predicted to be after Oct 1. With the transportation from Xinjiang to inland, the large quantity of new cotton will be after Nov in inland. Therefore, mills tend to replenish stocks intensively after the end of state cotton auction and before the arrivals of new cotton.

4. Logistics issue in end 2017

In end of the year, logistics from Xinjiang to inland is always a problem. The transportation from Xinjiang to inland is difficult with the intensive arrivals of cotton in Xinjiang. The higher freight costs and possible supply shortage in inland may pep up the cotton prices. Moreover, the growing costs to plant cotton crops rise generally and loans from Agricultural Development Bank are difficult. Therefore, cotton prices are likely to rise before 2018.

III. Market forecast

Bulls and bears can be changed into each other in most time. After analysis, for bears, the driven forces are basically confirmed under the current policy environment, while for bulls, the sharp decline of selling volumes of reserved cotton is considered to be hard to appear because the government has made adequate preparation for this round of cotton auction. Though the selling volumes of reserved Xinjiang cotton decline generally at present, no big problem is seen. And there are only two months left, the state cotton auction is likely to be implemented normally. In addition, for the intensive replenishment of mills, according to CCFGroup’s survey, no matter in inland or in Xinjiang, most medium and large mills has refill adequate cotton stocks, to last about two to four months and small and medium mills also have one to two months’ cotton stocks. So the intensive replenishing quantity may decrease in Aug, 2017.

In general, under current policy and environment, the bears are more influential on the cotton market and cotton prices are likely to decrease, but the market may also see short-term rebound driven by bulls.