China Securities Regulatory Commission has approved Zhengzhou Commodity Exchange to launch cotton yarn futures transaction on Jun 30, but the specific time for listed trading has not been published. What we have to know about cotton yarn futures? What should we pay attention to? The following part will have brief analysis on the basic knowledge for cotton yarn futures.

1. Which cotton yarn is the trading category? Ring-spun carded 32S grey cone yarn.

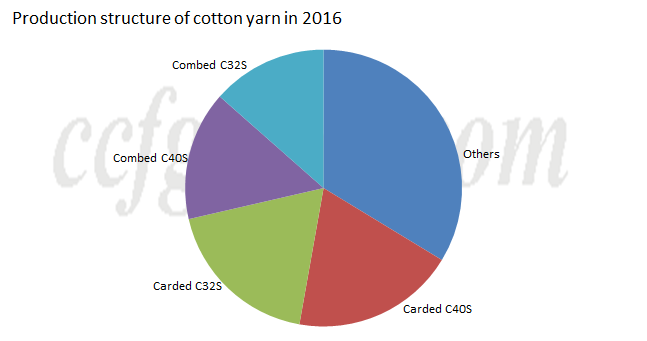

Choosing carded C32S as the trading category is because production of it is huge in China despite of reduction in recent years. Based on CCFGroup assessment, production of carded cotton yarn 32S was around 1160kt in 2016, sharing around 18.6% of national output total.

Currently, production of carded cotton yarn 40S and 32S is basically flat. Chinese carded cotton yarn below 32S is impacted by imported corresponding ones, and some Chinese cotton yarn plants turn to produce carded 40S or combed cotton yarn to avoid competition from markets like India and Vietnam. Carded cotton yarn 32S is a common variety with low production difficulty, and ordinary spinners can also reach the standard.

2. How about the manner of delivery? Factory delivery will be applied in early period of futures launch and warehouse delivery will be implemented after market operation stabilized.

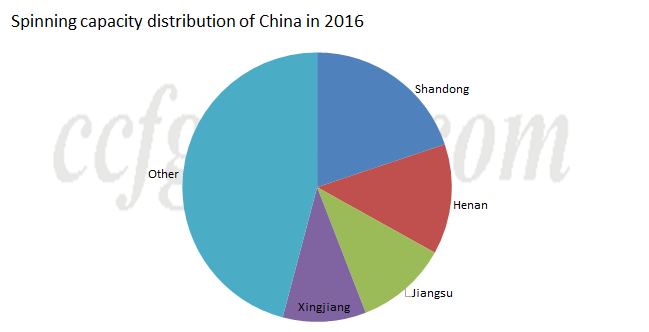

Cotton yarn futures will adopt factory delivery in early period, and the benchmark delivery places include Henan, Shandong and Jiangsu, assisted by Zhejiang (setting premium according to the freight). The specific factory list has not been published, but the benchmark delivery places have been confirmed. Shandong, Henan and Jiangsu are major cotton yarn production areas in China, with the production in Shandong ranking top one, followed by Henan, and Zhejiang is major cotton yarn consumption area in China, making it more convenient to operate.

Hubei and Hebei also have large cotton yarn production capability, and Fujian’s proportion is also huge, yet mainly manufacturing chemical fiber yarns.

3. Trading category is cotton yarn, will it include imported cotton yarn? Imported cotton yarn is not included in early period of futures launch.

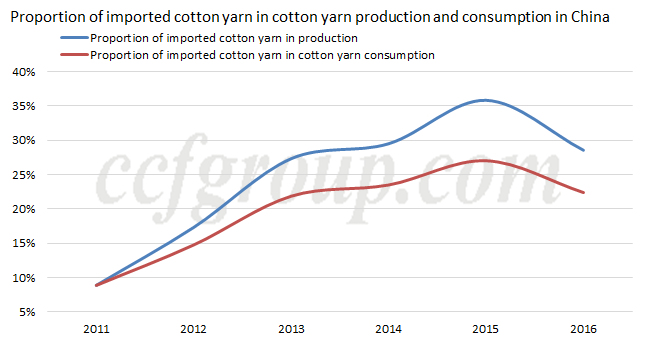

In early period of futures launch, imported cotton yarn is not allowed to be traded to guarantee stable operation on cotton yarn market, but it may be included later after cotton yarn futures market stabilized. The factory will have some measures to avoid imported cotton yarn being traded, but the enforcement remains unknown now. Consumption ratio of imported cotton yarn is big in China although cotton yarn imports have slipped in 2017 on narrower price spread between imported and Chinese cotton yarn, while the influence cannot be ignored.

Proportion of imported cotton yarn in total cotton yarn consumption was around 27% in 2015 but declined to around 22% in 2016, which may edge down further in 2017, likely to stay at around 20%. Will market players use cotton yarn futures to trade imported cotton yarn later still needs further observation.

4. How about the trading process?

The delivery unit is at 20 tons (conditioned weight), which should meet the requirements of “the same producer, batch and cotton proportion”. Before the delivery month, other cotton yarn excluding the benchmarked carded C32S can realize real objet procurement by turning futures into spot goods. Entering the delivery month, during the 1st-9th trading day, other cotton yarn excluding the benchmarked carded C32S can realize delivery by self-reported premium and discount, and the standard warehouse receipt delivery can also be used. On the 10th trading day, only standard warehouse receipt delivery can be used to guarantee the delivery consistency.

5. What should cotton yarn plants pay attention to after cotton yarn futures launched?

First, cotton yarn product will arouse the attention from other industries, which may intensify the fluctuation range on cotton yarn market.

Second, cotton yarn plants need to learn how to use cotton and cotton yarn futures to lock in cost and profit. Although not all cotton yarn plants will participate in cotton and cotton yarn futures, learning related knowledge is of great necessity.

Third, cotton yarn plants can add selling channels, and weavers should pay attention to whether the quality of the delivery category can meet their demand.

Fourth, trade mode of cotton futures have changed greatly in recent years, and on-call trade is increasing. Will the trade mode on cotton futures adopted on cotton yarn futures in the future should be noted.