Imports of Vietnamese cotton yarn keep growing although overall imports of cotton yarn are decreasing in China, and Vietnamese cotton yarn has aroused much concern from market players. Surging imports of Vietnamese cotton yarn is mainly attributed to the flow-back of cotton yarn from Chinese companies invested there or to the growth in trade sector? Which are major cotton yarn descriptions imported from Vietnam?

1. Imports of Vietnamese cotton yarn in China

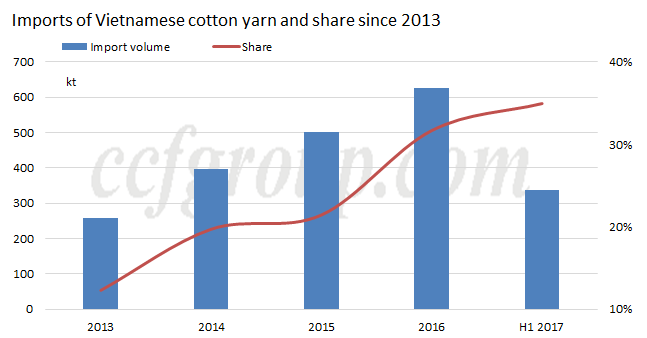

Imports of Vietnamese cotton yarn are increasing in China, at 258kt in 2013, sharing around 12.3% of the total and with monthly volume at 21.5kt, rising to 625.1kt in 2016, sharing 31.69% of the total and with monthly volume at 52.1kt. In Jan-Jun, 2017, cotton yarn imports totaled around 336.8kt, occupying 35% of the total and with monthly level at 56.1kt. Vietnam dominated imported cotton yarn market in China despite overall reduction, with market share at around 34.3% of the total in H1 2017.

Vietnam is a hot investment region for many Chinese companies and several Chinese companies like Texhong, Bros Eastern, Huafu, Jiangsu Yulun and Luthai established factory there. Many cotton yarn produced by the Chinese companies invested there flow back to China. Does the growth of Vietnamese cotton yarn in China mainly contributed to the flow-back from Chinese companies there?

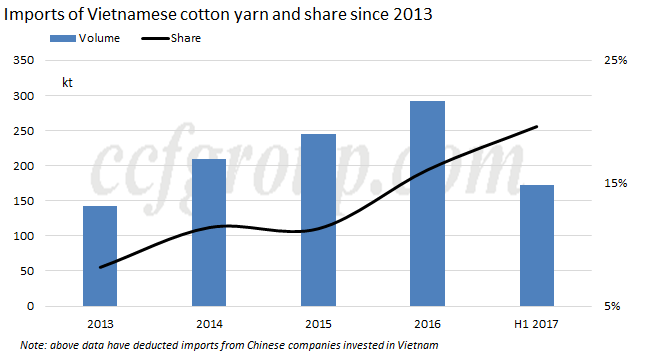

Deducting the cotton yarn from Chinese companies invested there, imports of Vietnamese cotton yarn also increased apparently. Imports of Vietnamese cotton yarn were around 143kt in 2013, taking up 8.16% and with monthly volume at 12kt, rising to 291.4kt in 2016, possessing 16.1% of the total and with monthly level at 24.3kt, and at 172.3kt in Jan-Jun, 2017, sharing around 19.62% of the total and with monthly volume at 28.7kt.

Soaring Vietnamese cotton yarn is likely to be mainly attributed to the following reasons: 1. Compared with Indian and Pakistani cotton yarn, imports of Vietnamese cotton yarn enjoy tariff free advantage. Cutting price means squeezing margins for some Vietnamese cotton yarn plants, but for many Indian and Pakistani cotton yarn mills, price reduction means losses. 2. Vietnamese cotton yarn is mainly made of imported cotton, which can lock in cotton cost in advance and reduce the influence from local cotton production change. In recent 1-2 years, cotton production in Pakistan and India is low, resulting into high cotton price and diminishing the competitiveness of cotton yarn on global market. 3. Delivery cycle for Vietnamese cotton yarn is shorter, with risk more controllable. Vietnamese cotton yarn can be delivered to Guangdong from North Vietnam that day by land transportation, and it will take around 2-3 days to Zhejiang, Jiangsu and Shandong by land transportation. It will take around 7-15 days if shipped by sea, and the delivery time will be around 15-30 days for Indian and Pakistani cotton yarn. Thus, choosing Vietnamese cotton yarn can reduce risk when market is volatile.

2. Major imported Vietnamese cotton yarn in China by count

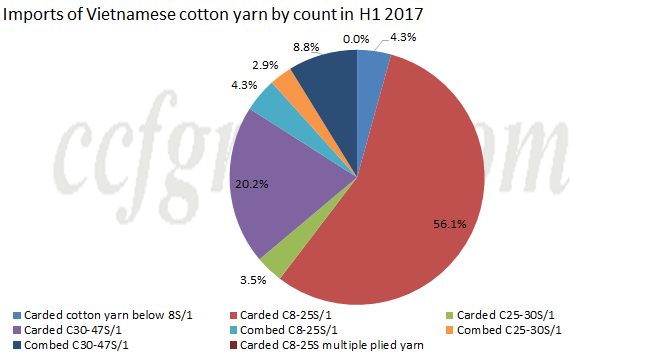

Imports of Vietnamese carded 8-25S/1 shared more than 56% of the total, hitting market expectation, and those of carded 30-47S/1 ranked the second place, possessing 20.17% of the total, far lower than anticipation. In actual circulation of imported cotton yarn, imports of Vietnamese carded 32S seemed to be higher than those of carded 16S and 21S.

After deducting imports from Chinese companies invested there, the result changed slightly but did not alter fundamentally. Market share of carded 30-47S/1 rose to 31.60%, but that of carded 8-25S/1 was still above 50%, which may be related with the surging of open-end low-count cotton yarn in Vietnam and growing imports of carded 21S contamination free.

In summary, hiking Vietnamese cotton yarn not only comes from the flow-back of cotton yarn from Chinese companies invested there, but also from the growth of trade sector. Imports of Vietnamese carded 8-25S/1 occupied more than 50% of the total, which may be different from market feeling that imports of carded 21S are bigger than those of 16S and 21S. It may be related with the rising of open-end low-count cotton yarn in Vietnam, but such conjecture still needs further research.