I. Current situation of long staple cotton market

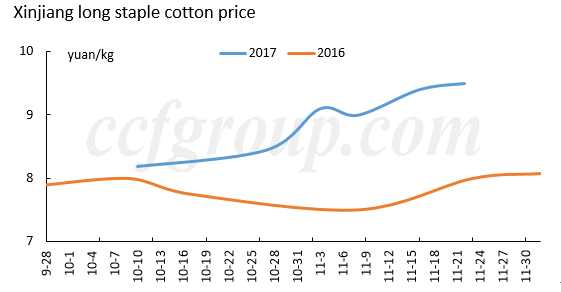

Price of Xinjiang long staple cotton kept rising steadfastly in 2017, rising from 8.18-8.2 yuan/kg at the beginning of October to 9.5 yuan/kg now with 16% increase. One of the reasons is that the arrivals of long staple cotton was insufficient for mills, which led to seed cotton price rising.

With the increase of processing volume of long staple cotton, the price of new cotton was gradually fixed. Offers of 17/18 long staple cotton were at 25,000 yuan/mt conditioned weight, ex-works in Xinjiang, in the first half of November. With seed cotton price rising constantly, theoretical cost of lint cotton rose to around 26,800 yuan/mt(no consideration to wastage). However, due to low affordability of mills, offers were still around 25,000 yuan/mt.

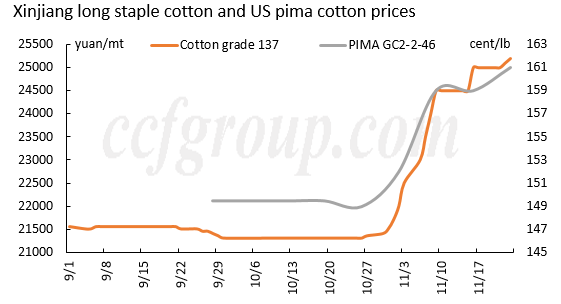

In fact, long staple cotton stock was sufficient as of the overproduction of long staple cotton in 2016, mills preferred the low-priced old cotton. Offers of 16/17 long staple cotton grade 137A were at 21,500 yuan/mt conditioned weight, ex-works inland, in September. Therefore, for the price of new cotton was high, downstream mills turned to purchase a large number of old cotton. Driven by demand, offers of 16/17 long staple cotton grade 137A rose 2,000 yuan to 23,500 yuan/mt, up by 9.3%.Then trading atmosphere of lint cotton cooled down.

Due to higher raw material prices and better sales of cotton yarns with count above 80s in November, high count cotton yarn prices was propping up. Mills mostly kept offers steady temporarily, but may raise prices later. Inventory level of mills lowered and some even saw tight supply.

Because of the overproduction in 2016, margins of Xinjiang long staple cotton are not favorable, but profits of fine staple cotton are impressive. Therefore, domestic long staple cotton planting area decreased about 45%, while output in two international planting areas (US and Egypt) went up largely. USDA estimated that US pima output in 2017 will be about 16,800 tons with 35% increase, and Egypt long staple cotton output is about to be 76,000 tons with 105% increase. Thus, international long staple cotton supply is basically enough.

Higher Xinjiang long staple cotton price also influenced international long staple cotton. CIF price of US pima escalated as well, price of pima GC2-2-46 increased by 7.7% from 149.5 cents per lb at the beginning of year to 161 cents per lb now.

According to the contract data between China and the US about long staple cotton, the imported pima from the US shot up during the time domestic long staple cotton came into the market, mainly because the domestic long staple cotton market was strong with the support of cost, while the price of US long staple cotton went down due to the increase production, which led to a big interest margin.

II.Reasons of price rising

Three main reasons through sample survey to ginners, traders and mills in Aksu.

1. Output reduction caused price rising

Due to the lack of labors, arrival of seed cotton was delayed in October and November. According to some ginners and farmers in Aksu, per unit yield of long staple cotton decreased evidently this year because of cotton bollworm. Output could reach 300 kg/mu in 2016, but estimated to be less than 200kg/mu this year, or even to 150kg/unit. If so, output of long staple cotton will be only 52,800-70,400 tons, way less than one-year consumption. Even if the stock is enough at the beginning of 2017 due to the overproduction in 2016, mills will run short of cotton by the end of this year. Increasing purchasing intention plus slower arrivals of long staple cotton, the price of long staple seed cotton will steadfast rise.

2. Rising cost of labors

Some traders hold different opinions that the decrease of long stpl;e cotton yeild will not be large. Cotton planting in Xinjiang is now quite standard, therefore, once pests occur or are expected to occur, cotton farmers will take measures to reduce the loss. Half loss in yield is only for some area, so the production may only fall slightly from previous estimation. However, lacking of labors is really a big problem. Since yield of long staple cotton is less than fine staple cotton, workers tend to pick the latter. So the labor cost increased to around 3 yuan/kg, which also caused seed cotton price rising.

3. Speculation

Some though it's a speculation, especially long staple cotton traders and mills. They thought that yields of new cotton are impossible to decrease largely, but long staple cotton stocks in 2016-2017 are heavy. Short-term supply and demand imbalance was a good opportunity to reduce the stock by speculation. Because cotton seed price was low in 2017, the price of long staple cotton seed dropped from 2.33 yuan/kg in 2016 to 1.8 yuan/kg, so that old cotton had obvious cost and price advantages. Since rising price of long staple seed cotton increased the expectation for lint cotton price, downstream mills preferred to buy old cotton, which has a basically same quality and a lower price, so the stock can be consumed.

III. Summary

Long staple cotton price rose as well as lint cotton, so that mills tended to buy old cotton which has a basically same quality and a lower price. Domestic cotton price rise leads to a rising price of foreign cotton. However, the internal cause is uncertain with an imbalanced short-term supply and demand. Low temperature and frost weather in Aksu will influence the quality of unpicked long staple cotton, and moreover, damage the yield. But the production is impossible to decrease dramatically.