On May 16, ZCE cotton futures market moved upward strongly and it has reached the maximum increase of 4% when the market ended in the morning. Large volumes of shorts entered the market to depress the market on the night of May 16 and May 17, but the upward trend was firm and in the afternoon of May 17, the market rebounded again. Jan’19 contract has risen by 855yuan/mt in two days.

This round of surge gains much attention and most players thought it was affected by the bad weather condition in Xinjiang, which will be influenced the cotton output in new season. Then, what about the fact?

Firstly, the weather condition in Xinjiang.

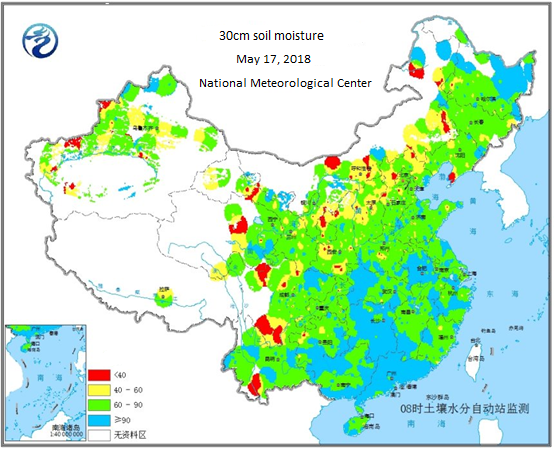

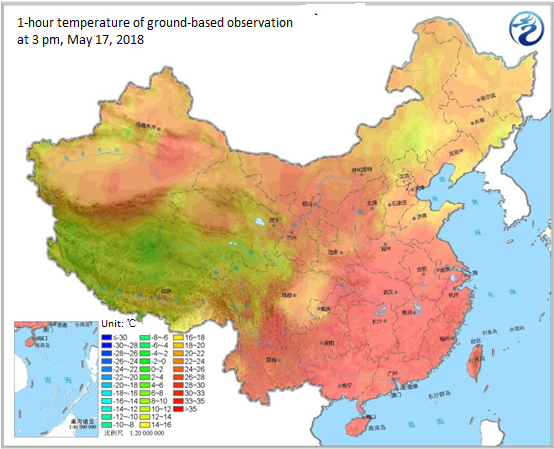

In recent weeks, Xinjiang experienced excessive rainfall and low temperature, especially in North Xinjiang. On May 17, the 30cm soil moisture has reached 60-90% and the daily highest temperature is 0-18℃ in most areas. Xinjiang growers reflected that the excessive rainfall and low temperature would indeed influence the sprout of cotton crops during the growing process, but the losses are not severe at present.

In fact, the weather of Xinjiang did not turn worse suddenly. The weather forecast has hint gale alert in previous week and blue alert of rainfall. Cotton producing areas have been damaged, but local growers have taken measures immediately and re-sowing has kicked off in some areas.

The weather forecast has not shown improvement in the next few days. By May 20, short-time heavy rainfall, thunderstorm, gale and hale may appear in Kashgar, Kizilsu Kirghiz and Aksu. In the next ten days, the temperature in North Xinjiang is supposed to decline by 5-8℃.

However, according to CCFGroup’s survey, Xinjiang growers have no big worry about the cotton output, as the weather in Xinjiang is changeable and the cotton crops can be replanted, although the costs may increase.

Secondly, the fundamentals.

In China, the state cotton auction is going on and cotton supply on spot market is also high. Though cotton yarn market sentiment is favorable currently, some markets have signs of weakness gradually. Supply and demand situation did not change in the traditional buoyant season during Mar and Apr, and the unbalanced situation continues.

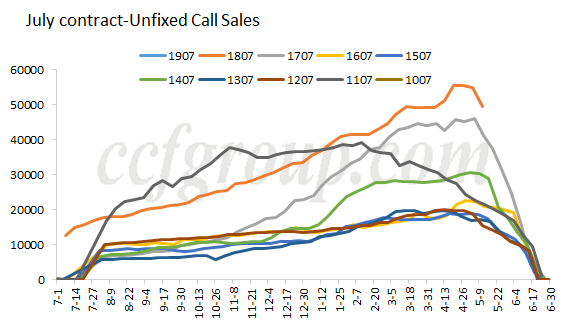

In international market, ICE cotton futures market keeps strong overall. Nevertheless, the spot cotton sales are slow and large quantity of on-call contracts is unfixed. Un-fixed on-call Jul contracts have reached the turning point to decrease. If the positions of Jul contract move to Dec contract, five months are left and will the longs still have strong confidence to move up the prices further?

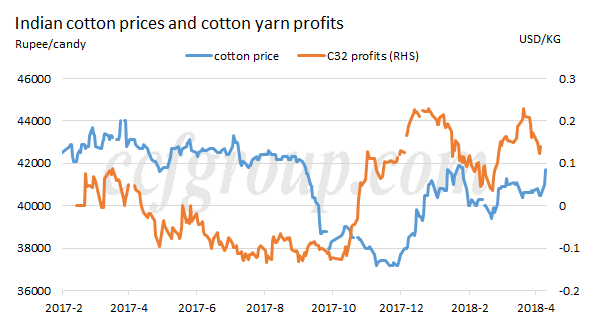

For Indian cotton market, downstream yarn profits are relatively good and the fundamentals are also favorable according to the data of USDA and CAI. Then, will the market be bullish? Indian cotton yarn witnesses good profits this season. During Aug and Oct, 2017, cotton prices moved lower sharply affected by the expectations of higher output, and yarn profits were good. Later, as the fundamentals were revised gradually, cotton prices soared, and profits did not rise further. Later, the cotton prices shivered in certain range. Actually, Indian cotton prices have been firmer in Apr, but due to the large depreciation of Indian Rupee against US dollar, USD prices of Indian cotton were relatively week. By end Apr, the arrivals of new cotton have reached 86% of the target, so in short run, Indian cotton market is not expected to see sharp change.

Lastly, Zhengzhou cotton futures market itself.

ZCE cotton futures market has rebounded from the bottom in April, and in early May, Jan’19 contract went firm. Nevertheless, after Sep’18 contract met the resistance level, the market kept range-bound during the second week of May. After a period of range-bound, the market moved lower, but it was hard to go down further, then the market tried to go upward. In short term, the technical indicators keep stronger and the overall trend maintains firm.