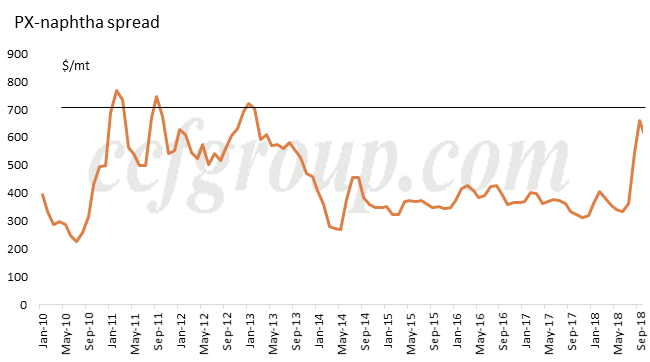

Asian PX-naphtha spread surged to retouch its historic high in Aug-Sep, after four years of fluctuations. It was obvious that the situation was not caused simply by participants’ behavior. Instead, supply-demand fundamentals were tight, which drove up PX-naphtha spread, but how long could it last?

PX capacity growth has been slower than that of polyester capacity for more than 3 years, as a result, the oversupply of PX has been alleviated notably in 2018. PX market has entered a boom cycle, although there’re heavy plant startups in 2019.

In PX-PTA-polyester chain, the supply of PTA grows faster than that of polyester, which means that PTA supply is no longer tight. In addition, PTA plants are unlikely to shut for turnarounds in large scale in the fourth quarter in the consideration of PTA and downstream polyester economics.

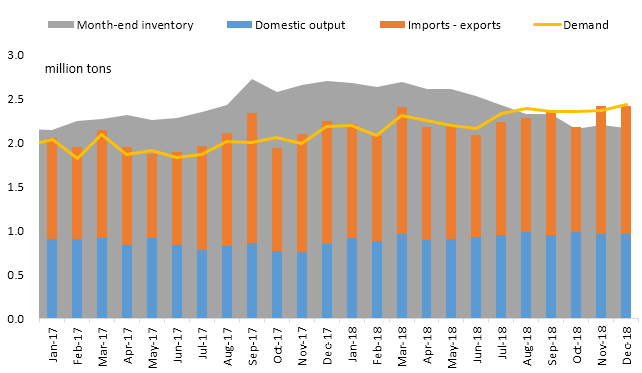

It is another story for PX, which is short supplied throughout the first three quarters of 2018. China’s domestic PX supply deficit could get moderated in Q4 if Fuhaichuang (Dagon Aromatics) restarts its PX plant, however, the market will still feel a supply pinch as massive PTA production curtailment is unlikely.

The gap in domestic PX production needs to be filled by imports. However, whether the increase in PX imports could affect the market remains to be seen. It is reported that an additional 50kt PX per month is expected to arrive from the US in the fourth quarter.

According to CCFGroup’s calculation, when PX imports reaches 1.4-1.45 million tons per month and domestic production reaches 0.95-0.98 million tons, the appetite for feedstock PX could be sated to produce 3.6 million tons of PTA. It is calculated based on high operating rates of domestic PX plants. Domestic production could be ramped up to 1 million tons per month if Fuhaichuang restarts its PX plant.

In the longer run, PX supply-demand balance depends on the progress of domestic refining and chemical projects, as well as on the demand from downstream polyester sector.